The U.S. Supreme Court's recent Defense of Marriage Act (DOMA) ruling in Windsor has important federal tax implications for same-sex couples who are legally married under applicable state law. (A second Supreme Court case involving California's Proposition 8 affects same-sex couples in that state.)

However, the tax results of being married are not always favorable. Here are the ways that the individual tax situations of some same-sex couples will change in the wake of the Supreme Court rulings.

Facts of the June 26 Supreme Court Rulings 1. Edith Windsor and Thea Spyer were married in Canada and resided in New York, a state that recognizes same-sex marriage. Spyer died in 2009 and left her entire estate to Windsor.  Windsor sought to claim the federal estate tax exemption for surviving spouses, but was barred from doing so by Section 3 of DOMA. Windsor paid $363,053 in estate taxes and sought a refund, which the IRS denied. Windsor brought a refund suit, contending that DOMA violates the principles of equal protection incorporated in the Fifth Amendment. In a 5-4 decision, the Supreme Court ruled that same-sex married couples in states that recognize their marriages must get the same federal benefits that opposite-sex couples receive. DOMA "contrives to deprive some couples married under the laws of their State, but not others, of both rights and responsibilities, creating two contradictory marriage regimes within the same State," the ruling stated. "It also forces same-sex couples to live as married for the purpose of state law but unmarried for the purpose of federal law..." (Windsor, No. 12-307) 2. California voters passed a ballot initiative known as Proposition 8, amending the state Constitution to define marriage as a union between a man and a woman. Same-sex couples who wished to marry filed suit. The U.S. District Court declared Prop 8 unconstitutional and prohibited public officials from enforcing the law. After public officials didn't appeal, private parties did. In a 5-4 decision, the Supreme Court declined to rule, stating the parties appealing the District Court's order did not have standing to do so. (Hollingsworth v. Perry, No. 12-144) The decision cleared the way for California to recognize same-sex marriage, which it did on June 28. |

Other Implications for Same-Sex Couples In addition to tax and estate planning implications, the Supreme Court Windsordecision could affect same-sex married couples in other areas including:

|

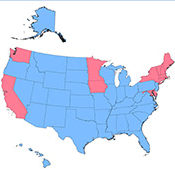

Where Is Same-Sex Marriage Recognized? California, Connecticut, Delaware*, Iowa, Maine, Maryland, Massachusetts, Minnesota**, New Hampshire, New York, Rhode Island**, Vermont, Washington and the District of Columbia *Effective date was July 1, 2013 |

Being Married for Federal Tax Purposes

With one big exception, the Internal Revenue Code generally provides married individuals with more advantages than it provides single taxpayers.

Advantage 1: Marriage Bonus

When two individuals are considered married for federal tax purposes, filing a joint return usually results in a lower combined federal income tax bill than if the couple was unmarried in these cases:

- One spouse earns most or all of the income.

- The income is a healthy amount.

Reason: With a joint return, more of the higher-earning individual's income is taxed at lower rates. This is the marriage bonus in action.

Advantage 2: Tax-Free Employer Benefits

When a couple is married for federal tax purposes, one spouse can receive certain tax-free benefits from the other spouse's employer. The most common examples are tax-free healthcare coverage and tax-free reimbursements from flexible spending account (FSA) plans.

Advantage 3: Treatment of Inherited Retirement Accounts

When two individuals are married for federal tax purposes and one spouse dies, the surviving spouse can roll over qualified retirement plan balances inherited from the deceased spouse into the surviving spouse's own Individual Retirement Account (IRA). Then, the surviving spouse can put off taking annual required minimum distributions (RMDs) from the rollover IRA until after he or she turns 70 1/2.

In contrast, when a non-spouse inherits a qualified retirement plan balance and transfers it to an IRA, he or she will usually have to start taking RMDs sooner and in larger amounts, which means less tax deferral benefits.

When one spouse dies, the surviving spouse can also roll over IRA balances inherited from the deceased individual into the surviving spouse's own IRA. Once again, the RMD rules that apply in this situation allow surviving spouses to collect more tax deferral benefits.

Advantage 4: Gift and Estate Tax Rules

Two individuals who are married for federal tax purposes can make unlimited gifts to each other while still alive without any negative federal gift or estate tax consequences (assuming the transferee spouse is not a non-resident alien).

If one spouse dies:

- The surviving spouse can be left an unlimited amount free of any federal estate tax, thanks to the unlimited marital deduction privilege (as long as the surviving spouse is a U.S. citizen).

- The deceased spouse's unused unified federal gift and estate tax exemption ($5.25 million for 2013) can be left to the surviving spouse. That way, the surviving spouse can shelter more gifts from the federal gift tax and have a bigger federal estate tax shelter when he or she dies.

Advantage 5: Deductibility of Alimony Payments

After being married for federal tax purposes, certain court-ordered payments to a spouse or ex-spouse can qualify as deductible alimony. In contrast, transfers of money between unmarried individuals are generally not deductible, and they may be treated as gifts for federal tax purposes.

Disadvantage: Marriage Penalty

The one big disadvantage of being considered married for federal tax purposes occurs when both spouses have healthy amounts of taxable income. In this scenario, a couple that is considered married can wind up with a bigger combined federal income tax bill than if the two individuals had remained single taxpayers. This is the so-called marriage penalty in action.

Result: A same-sex couple in this scenario that is considered married under applicable state law can actually benefit from being considered unmarried for federal tax purposes.

Immediate Impact

Because it apparently only affects same-sex couples that are considered legally married under applicable state law, the Supreme Court's rejection of DOMA in the Windsor decision may not have the immediate widespread impact you might expect. Here's why:

The majority of states do not currently recognize same-sex marriage.

Some couples who were legally married in a state that recognizes same-sex marriages now reside in states that do not recognize them.

Several states only allow same-sex couples to enter into civil unions or domestic partnerships (as opposed to same-sex marriages).

- Currently, 30 states have constitutional bans on same-sex marriages. There are also at least eight lawsuits dealing with state same-sex marriage bans pending in state and federal courts.

Unanswered Questions

As we await guidance from the IRS and other federal agencies in this still-unsettled legal environment, some of the important unanswered questions are:

1. Will same-sex civil unions and domestic partnerships be treated the same as state-law same-sex marriages? If the answer is yes, more same-sex couples will be considered married for federal tax purposes. If the answer is no, only couples that were united in the states that permit same-sex marriages would be considered married for federal tax purposes.

2. Will same-sex couples who were legally married in one state but live in another state that does not allow same-sex marriages be considered married for federal tax purposes?

3. Can spouses who were taxed on healthcare (or other benefits) for their same-sex spouses file amended returns and claim refunds? What about their employers that withheld and paid FICA tax on benefits for same-sex married couples? Will there be a procedure for employers to claim refunds for overpaid federal employment taxes?

4. Should same-sex married couples amend federal tax returns they filed in previous years? For which years? Should they file protective claim now while waiting for the IRS to issue guidance?

5. How about same-sex married couples who filed an extension for 2012 to file their returns by October 15? How should they file?

These are only a handful of the many tax questions being asked after the Windsor Court ruling.

Conclusions

The Supreme Court's decision now allows same-sex couples who are married and reside in states that recognize same-sex marriages to be treated as married for federal tax purposes. In some cases, filing amended returns for previous years may result in federal tax refunds.

Same-sex couples who are covered by civil union and domestic partnership statutes apparently still face uncertainty about whether they can be treated as married for federal tax purposes. These individuals should consult their tax advisers about how to proceed.

Currently, nothing has changed for members of same-sex couples who are not considered legally married or covered by civil union or domestic partnership statutes. They are still considered unmarried for federal tax purposes.