The IRS uses "Collection Financial Standards" to help determine a taxpayer's ability to pay a delinquent tax liability. Allowable living expenses include those that meet the test of being necessary to provide for a taxpayer's (and his or her family's) health and welfare, as well as his or her ability to produce income.

The IRS uses "Collection Financial Standards" to help determine a taxpayer's ability to pay a delinquent tax liability. Allowable living expenses include those that meet the test of being necessary to provide for a taxpayer's (and his or her family's) health and welfare, as well as his or her ability to produce income.

The IRS allowable living standards are designed to incorporate necessary items including a category for out-of-pocket health care expenses and an allowance for cell phones.

Higher costs may be allowed by the IRS if a taxpayer can prove that these amounts are inadequate.

Here are four categories showing the basic amounts allowed by the IRS in calculating delinquent tax payment amounts (effective March 25, 2019):

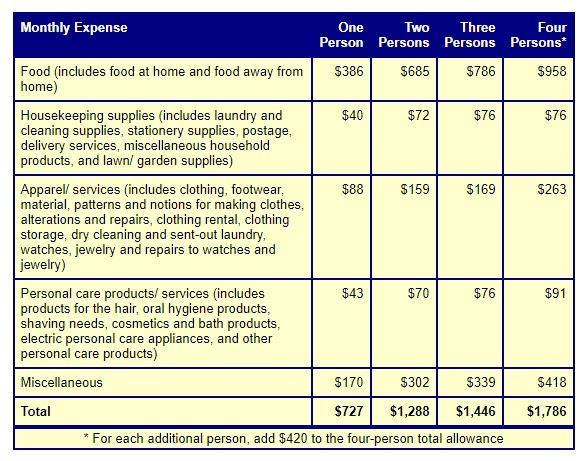

1. Food, Clothing and Miscellaneous Items

National monthly standards have been established for five necessary expenses of food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous items.

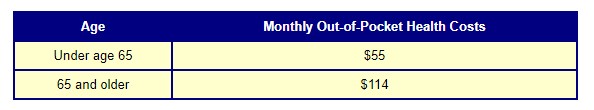

2. Health Care

National out-of-pocket health care standards have been established for out-of-pocket expenses including medical services, prescription drugs, medical supplies, eyeglasses, contact lenses, etc. This monthly amount is allowed per person in addition to what is paid for health insurance.

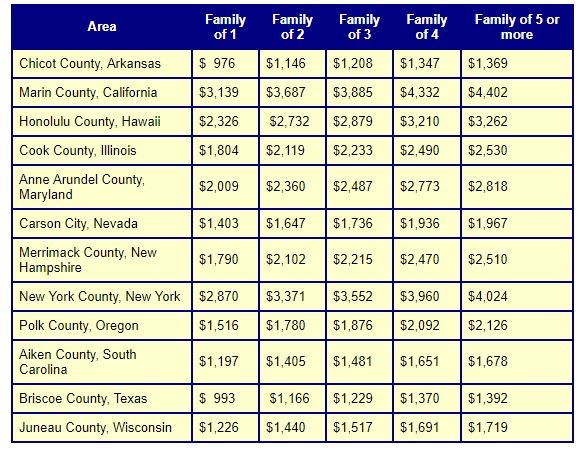

3. Housing and Utilities

The monthly standards for housing and utilities are determined on a local basis. The amounts allowed for a particular area and family size cover a taxpayer's primary residence. They include mortgage or rent, property taxes, interest, insurance, maintenance, repairs, gas, electric, water, heating oil, garbage collection, telephone and cell phone.

As you might expect, the allowances vary widely across the nation. Here are some examples:

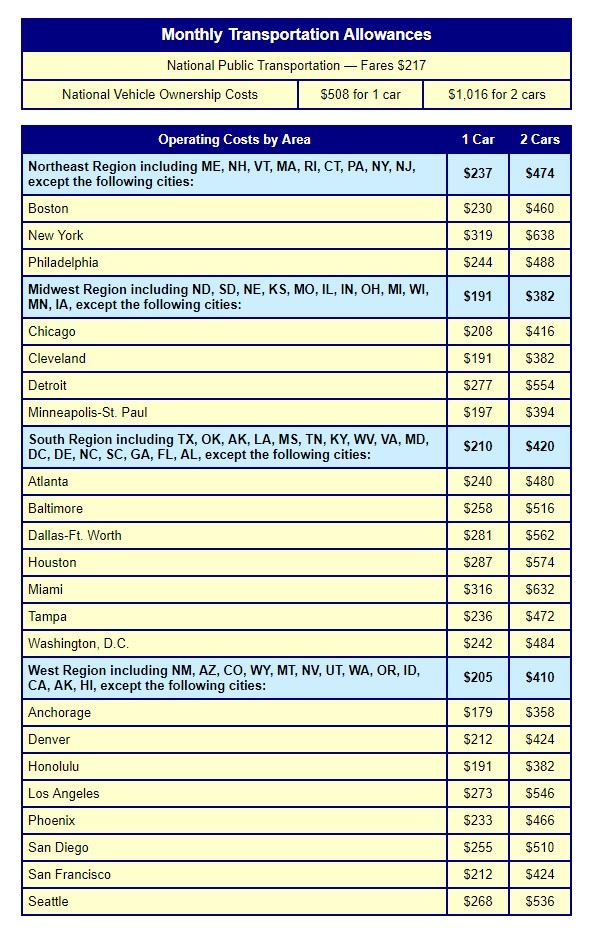

4. Transportation

Transportation standards for taxpayers with a vehicle consist of two parts:

- Nationwide amounts for monthly loan or lease payments — called ownership costs.

- Additional amounts for monthly operating costs, which include repairs, maintenance, insurance, fuel, registration, inspection, parking and tolls.

There's also a single nationwide public transportation allowance.